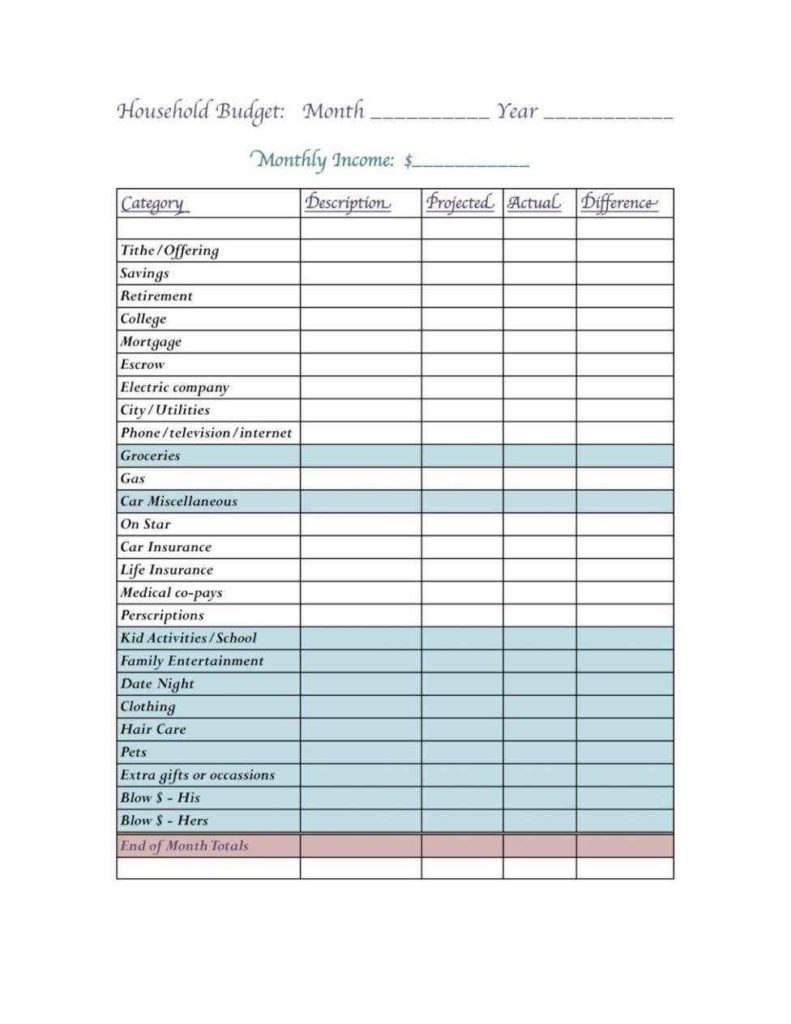

Let’s say you know you’re going to spend $700 on Christmas gifts. If you were to start budgeting for Christmas in June, you’d have 7 months to save up (including July and December). Let’s take the example of Christmas gifts. There is an option to ‘roll over’ budget categories from one month to the next or not. You’d have to delete the groups and recreate them manually. So, in the above picture, there is no way to click and drag the “savings” group to be under “yo momma’s house” group. Just click “HOUSING” and type your preferred title.Įach month, you have the option to copy your current month’s budget for next month or start fresh.ĭownside – You cannot move the category groups around. Or let’s say I prefer to change the budget group currently titled “HOUSING” to “YO MOMMA’S HOUSE.” Easy peasy. Or, since I don’t pay HOA dues, I can click the trash can and get rid of that line. You can see in the screenshot below I clicked ‘mortgage’ and can change it to ‘rent.’ You have control over how you classify them as well. You have complete control over the number and names of categories, just as you would in a spreadsheet. The customizability of EveryDollar gets and 8/10. In it, I address how EveryDollar stacks up against the 6 main features I want in a budgeting app: 1. (Detailed review of YNAB here.) In the meantime, here’s an completely honest EveryDollar review. While it has some good features, my husband and I both like YNAB much better. I have updated this post to reflect my current thinking abut EveryDollar after using it for 9 months. We used EveryDollar for 9 months, then switched to YNAB.

See my entire disclosure policy for all the boring details. When you make a purchase through an affiliate link, I earn a commission at no cost to you. Some of the links on this page are affiliate links.

0 kommentar(er)

0 kommentar(er)